Home / Natural Gas /

OMV announces third quarter trading statement

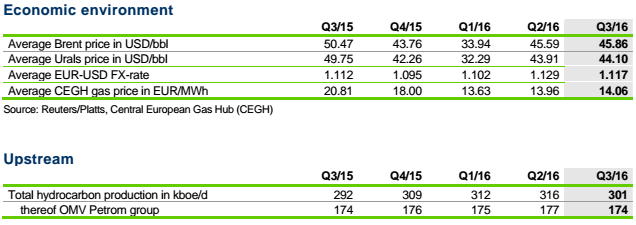

This trading statement provides basic provisional information on the economic environment as well as OMV’s performance for the quarter ended September 30, 2016. The OMV Group Q3/16 results will be published on November 9, 2016. The information contained in this trading statement may be subject to change and may differ from the final numbers of the quarterly report. All comparisons described in the trading statement relate to the previous quarter.

Sales volumes increased by 4% since part of Q2/16 production volumes were sold in Q3/16. Production decreased by 5% due to planned turnarounds in the Norwegian fields Gullfaks and Gudrun. Clean exploration expenses amounted to around EUR 50 mn in Q3/16. Despite lower production volumes, production costs in USD/boe remained stable. Absolute production costs further decreased, mainly as a result of ongoing cost saving initiatives. In addition, Upstream realized a positive hedging result in Q3/16. Upstream earnings were up compared to Q2/16. OMV recorded a small positive effect in the consolidation line in Q3/16, predominantly related to OMV Petrom.

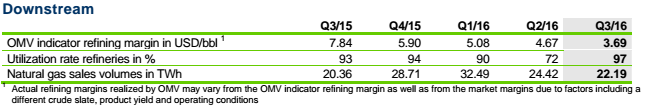

After the planned turnaround activities in Q2/16, the utilization rate of the refineries was back on a high level at 97% in Q3/16. Higher refined product sales more than offset the lower OMV indicator refining margin. The retail and commercial businesses experienced seasonally increased sales volumes. Retail and commercial margins were higher backed by strong customer demand for OMV’s products. OMV Petrol Ofisi’s performance was also seasonally strong. The performance of the petrochemicals business strongly increased due to higher sales volumes and improved product spreads. Downstream Oil earnings increased substantially. Downstream Gas again performed very well, including a one-time gain of around EUR 20 mn, mainly related to the clearance of a contract.

At-equity consolidated companies

Borealis contribution remained strong, driven by an improved performance of the base chemicals business, as well as a stronger contribution from Borouge.

Identified special items

Net special items of approximately EUR 100 mn have so far been recorded in Q3/16, mainly related to the divestment process of certain Upstream assets.

Group tax rate

Group tax rate is expected to be very low, driven by the strong contribution from at-equity consolidated companies. In addition, negative earnings contributions from high-tax Upstream countries will further contribute to the expected low tax rate.

Source: www.omv.com

Recent Comments