Romania – a Gas HUB. Why, today, this isn’t a project for Romanians?

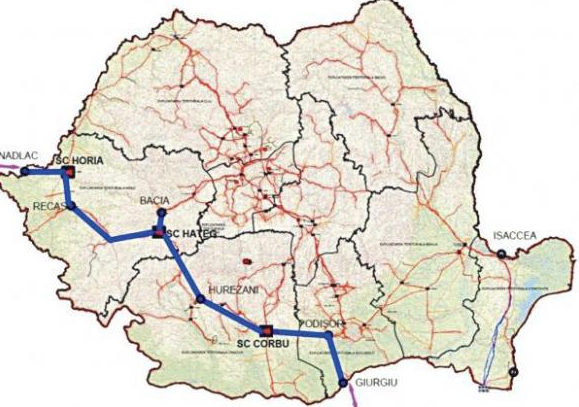

A national project insistently resumed lately is the development of a Gas HUB in Romania. Analyzing the possibility of materialization of this project, we consider that the opportunity was lost a few years ago, and the prospects for implementing a HUB in Romania are reduced. Then, who would benefit from such a project? Corroborating this project with other internal and external trends, we can say that it is a project that could be used to impose a monopoly in the South-East region. The HUB is primarily a point where supply and demand meet, and only ideally the meeting point for several physical gas flows, through the related infrastructure. The gas HUB is the place where transactions are made freely, transparently and competitively, a place for legitimate speculation, a place where a market must actually work. But a market, besides specific mechanisms, also needs: confidence from market players (suppliers, traders etc.), a sufficient number of renowned traders (with important financial resources) to eliminate the possibility of influencing the market in any way, significant gas flows and a predictable environment. Confidence: Romania is no longer trustworthy for large players on the gas market. The irreversible (short term) erosion of confidence in Romania is a result of the events of the past 17 years, period in which “one is said and another is done”, of repeated violation of the numerous commitments for gas market liberalization: 2000, 2005, 2007, 2010, 2012, 2014, 2016 and 2017 (none of them materialized). In our opinion, each time there was a violation of commitments made by the same leaders, who had a populist approach to breaching commitments in the name of the protection of gas consumers (false as evidenced by the way in which gas price has escalated in Romania over the last 17 years). Thus, the level of confidence in the Romanian gas market of large players is as negative as possible. For this reason, large players on the Western gas market no longer desire to enter the Romanian market. The Romanian market is (and we don’t see any change in the near future) made of players with a purely local horizon, which do not rely their strategy on a trading marketing, specific to HUBs, but on a retail marketing, speculating the lack of knowledge at the level of non-household consumers and the power (influence) of regulations at the level of household consumers. Traders: In Romania there are no traders, but wholesale and retail suppliers that, naturally, don’t want a functional market, except to a level they can control. Predictability: it is a concept that does not exist in Romania, almost in any field. Gas flows: The HUB is also the meeting point of several gas flows, important in terms of both entries and exits into/from the system. Unfortunately, Romania is no longer in a position providing it with the prospect of being crossed in the future by large gas flows (as the current trends show) and it does not have the technical capacity to allow the passage of such flows, determining interest in a HUB. Romania has important gas quantities that it produces from own fields, if we relate them to its consumption; it also has important gas resources that can be delivered locally, due to the reduced pressure regimes of fields, following the advanced state of exploitation, respectively gas resources that are not quite suitable for transmission over long distances to other areas in the region. Romania has an obsolete transmission system, designed to operate for pressure regimes lower than the operating pressure of the neighboring systems, which makes it inappropriate to be used as transit system and even less to ensure the easy transmission on north/south, south/north, east/west and west/east directions. Thus, Romania is not able to take over important gas quantities (first of all these quantities do not exist) to turn Romania into a physical gas HUB. In my opinion, in the context of the current steps, this situation will not change significantly even after building BRUA project. At the same time, we believe that Bulgaria’s geographic position may be more advantageous in terms of transit routes, by placing it in the way of potential gas flows, due to:

- a transmission system working at a 55 bar operating pressure, interconnected with the transmission systems of all its neighbors: Romania, Serbia, Macedonia, Greece;

- the border with Turkey, allowing Bulgaria to become a gateway to the EU for gas from the Caspian Sea, Iran, Iraq, Egypt;

- the border (agreements) with Greece, creating a gateway to the EU for gas from Israel and Cyprus (via Greece), as well as the only route of access to LNG of countries in South-Eastern Europe, on Greece-Bulgaria route. Notably, LNG will strongly in the future and the possibility of having access to a LNG terminal will play an important role in the development of HUBs.

- access to a possible route of South Stream (route that is expected to be realized, if Nord Stream 2 wins the battle against the representatives of the European Council).

The same situation of developing a gas HUB is also found in Hungary, which can position it ahead of Romania in terms of advantages, especially after giving up BRUA project and starting the construction of the STAR transmission system in Hungary. It is important to understand that European HUBs have not developed in countries with large gas production (Norway) or with large storage capacities (Denmark), but in countries with a good geographic location, with pipeline systems interconnected from and to various directions and especially attractive in terms of confidence in carrying out transactions.

Yet, under what circumstances could Romania become a HUB?

A Romanian HUB would involve the construction of a new vision on the natural gas market, of building a free, liquid, responsible, closely supervised market, developing ways to support vulnerable customers, uniquely dispatched to prevent crises and for exceptional situations and fully integrated in the European Energy Union. A HUB involves redesigning all the activities in the gas sector into a single purpose, to facilitate gas trading in order to obtain the best gas prices at a certain point and to ensure the quality of supply. In my opinion, I don’t foresee any of these happening in the future, so we are facing a project that is intended to be achieved without being able to function in the true sense of the word and in which I believe there wouldn’t be interest from the large European traders. Analyzing the gas market in Romania, one can notice a gradual decline starting with 2003 in gas exports to Romania and the reorientation of Russian gas exports to other markets, much larger (Germany, France, Italy). We believe that the situation has changed over the last 3-4 years, Romania becoming interesting again for the largest gas exporter of Europe, for the following reasons: 2016 has proven that imports in Romania can grow by even 629%, in a very short term, with considerable price margins, providing prospects for large gains over a very short period of time. The years of 2014, 2015 and 2016 have proven that prices on the Romanian gas market are determined by the import gas price. Liberalization of the Romanian gas market, imposed under GEO 64/2016, has shown that there is a possibility to establish prices on the Romanian gas market without having a significant influence of the import gas price. This could become upsetting and it does not apply only to the Romanian gas market, but also to the South-Eastern European market. Continuing liberalization, transparency and increased competition on the gas market in Romania could create the “danger” of a reference price, which would be upsetting in the region. Inventing a gas HUB in Romania could bring a limited number of players and especially the exclusive presence of those players that want to maintain their monopoly in the East-European region, resorting to a “transparent instrument”.

Translation from Romanian by Romaniascout.

Recent Comments